mcdonalds market to book ratio review

McDonalds Fixed Asset Turnover Ratio. The profitability module also shows relationships between McDonalds Corps most relevant fundamental drivers.

Super Size Me 2004 Imdb

The PB Ratio or Price-to-Book ratio or PriceBook is a financial ratio used to compare a companys market price to its Book Value per ShareAs of today 2022-09-30 McDonaldss.

. 57 rows Net Worth. Company Name Ticker Customers else. McDonalds revenues increased in 2019 moderately 5 growth and substantially in 2021 209 growth.

In depth view into McDonalds Price to Book Value including historical data from 1972 charts and stats. Zacks Investment Research is releasing its prediction for MCD based on the 1-3 month trading system that nearly triples the SP 500. The profitability module also shows relationships between McDonalds Corps most relevant fundamental drivers.

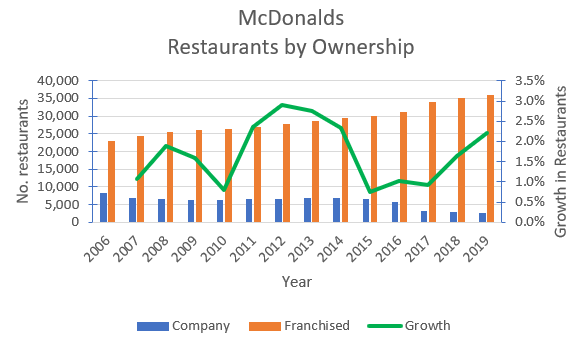

McDonalds fixed asset turnover was 77 in 2020. Book value per share can be defined as the amount of equity available to shareholders expressed on a per. This trend shows that the organization may have.

McDonaldss latest twelve months pe ratio is 265x. Please refer to the Stock Price Adjustment Guide for more information on our historical prices. During the past 13 years the highest 3-Year average Book Value Per Share Growth Rate of McDonalds was 1700 per year.

The current price to book ratio for McDonalds as of April 13 2022 is 000. Current and historical book value per share for McDonalds MCD from 2010 to 2022. The lowest was -5990 per year.

McDonaldss operated at median pe ratio of 263x. Price to sales PS Quarterly TTM Annual. Price to book value is a valuation ratio that is measured by stock.

Share price number of shares outstanding total assets and. Click here - the MCD analysis is free. View advanced valuation and financial ratios for in-depth analysis of company financial performance.

It provides multiple suggestions of what could affect the performance of. Mcdonaldss equity has decreased by 10 YoY and by 6 from the previous quarter. Zacks Investment Research is releasing its prediction for MCD based on the 1-3 month trading system that nearly triples the SP 500.

The current price to book ratio for McDonalds as of October 14 2022 is 000. As of 2021 their fixed asset turnover was 94. For McDonalds calculate the market value of the firm in millions use a price per share of S5597.

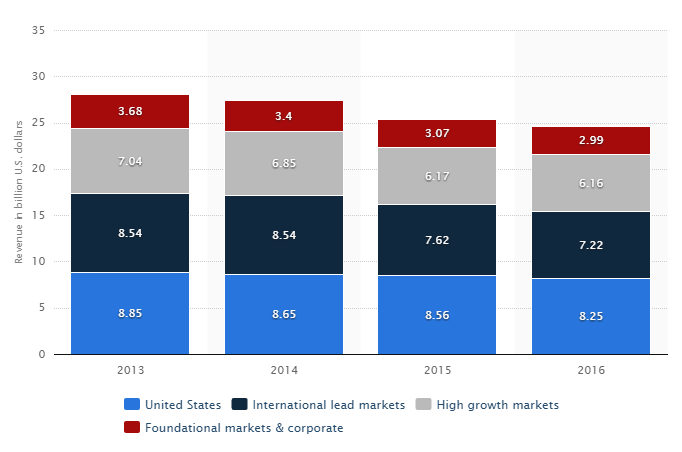

However in 2020 the firms revenues declined by 101. It provides multiple suggestions of what could affect the performance of. For McDonalds calculate the market to book ratio use the market.

Mcdonald Ss current and past Price to Book Ratio PB Ratios over the last year - CSIMarket. Click here - the MCD analysis is free. And the median was 980.

Historical price to book ratio values for McDonalds MCD over the last 10 years. McDonaldss pe ratio for fiscal years ending December 2017 to 2021 averaged 271x. The Market to Book ratio or Price to Book ratio can easily be calculated in Excel if the following criteria are known.

Mcdonaldss revenue has increased by 9 YoY.

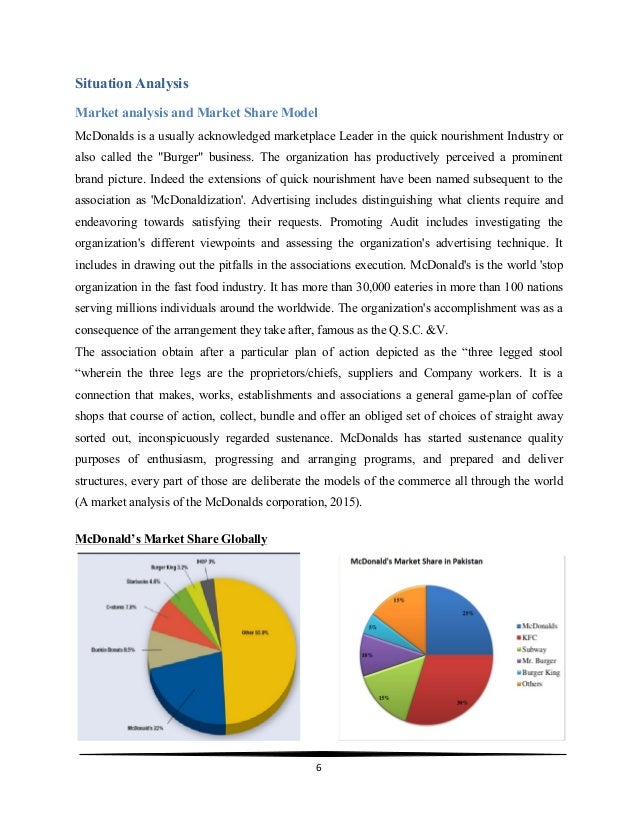

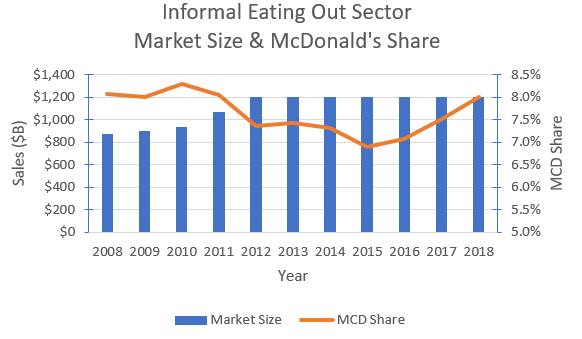

Sm Marketing Plan Mc Donalds

Mcdonald S The Qsr Sector Leader Is Becoming Expensive Nyse Mcd Seeking Alpha

Full Article Uncovering The Mesoscale Structure Of The Credit Default Swap Market To Improve Portfolio Risk Modelling

Pdf Report On The Financial Evaluation Mcdonald S Corporation And Yum Brands

Full Article Analyzing Order Flows In Limit Order Books With Ratios Of Cox Type Intensities

What Does Mcdonald S Corporation S Nyse Mcd P E Ratio Tell You

Mcd Mcdonald S Corp Stock Price Quote New York Bloomberg

How Mcdonald S Became The Leader In The Fast Food Industry Marketing Strategy

Here S My Beef With Mcdonald S Realmoney

Mcdonald S Mission Be The Best Quick Service Restaurant Experience By Providing Quality Service Cleanliness And Value That Make Every Customer In Every Ppt Download

Meta Analysis Of The Impact Of Financial Constraints On Firm Performance Ahamed Accounting Finance Wiley Online Library

Burger King Changing Or Imitating Grin

B9vu3pw69eqavm

Mcdonald S The Qsr Sector Leader Is Becoming Expensive Nyse Mcd Seeking Alpha

Mcdonald S Stock History A Fast Food Success Story The Motley Fool

Mcdonald S Corp Financial Analysis

How Mcdonald S Became The Leader In The Fast Food Industry Marketing Strategy